First-time homebuyers in NYC face many obstacles, but city, state and local support is available for those seeking a piece of precious real estate.

Shifting to a homeowner mentality is perhaps the first hurdle for many. New York is an unusually renter-heavy city: only about 30% of residents own their homes, far below the nationwide average of 66%, according to a March 2024 comptroller report.

Given the high cost of living in NYC, it’s no surprise that for would-be homebuyers, affordability is the primary obstacle for “all but the most affluent,” the comptroller report said.

Those looking to buy today face high prices, low inventory and relatively high mortgage rates, leaving many priced out of the market.

In particular, the Bronx lags behind with just a 20% homeownership rate — the lowest among the five boroughs, according to a 2021 report by NYU Furman Center.

Staten Island has by far the highest homeownership rate (nearly 70%), with Queens ranked second (45%), followed by Brooklyn (30%) and Manhattan (25%).

Wide racial gaps in homeownership persist in the city, as they do nationwide. Asians and whites in NYC have a 43-45% homeownership rate, with Black households at 28% and Latino households at 17%, according to the Furman Center report.

Nationwide trends also show that prospective buyers require more time and money than ever to purchase their first home.

The median age of first-time buyers is now 38 — nearly a decade older than it was in the 1980s, according to the annual National Association of Realtors (NAR) Profile of Home Buyers and Sellers, which covered transactions between July 2023 and June 2024.

The report also highlighted financial barriers, as repeat buyers are making the highest down payments since 2003, often forcing first-timers to pay more to compete.

But among those who found the right opportunity to buy at a young age is Haramritjot Singh, 34, who bought his first home, a five-bedroom house in Kingsbridge, with his wife in 2020. The couple had one child at the time and moved onto the same block as his parents, who own the house he grew up in.

Singh told the Bronx Times that he’d always aspired to buy a house, viewing it as a life milestone that he knew he’d achieve — but probably not before his mid-30s, he’d assumed.

Now, as a Punjabi American who became a homeowner at age 29, Singh said owning a house is deeply meaningful, especially given his family roots tied to agriculture in India.

“In many ways, owning a home here in America feels like the equivalent of owning land back home in that it’s a form of independence, legacy and security,” he said.

The American Dream

Amid the challenging climate, first-time buyers nationwide now make up a historically small share of the market at 24% — the lowest level since the NAR began collecting data in 1981.

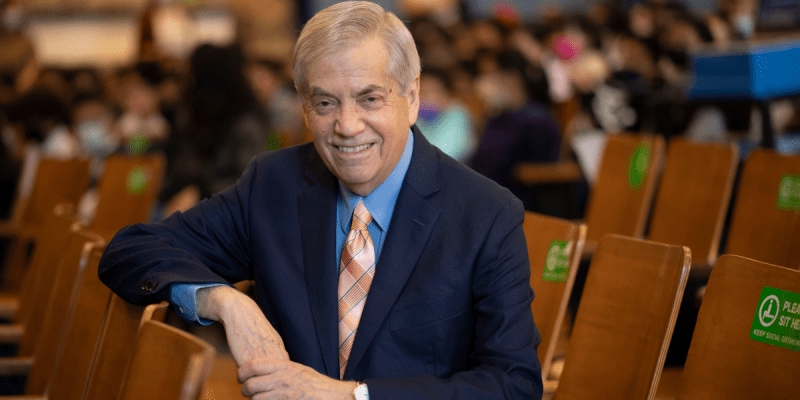

However, for those who can make it work, buying is always the best option, according to Gregory Tsougranis, a Keller Williams realtor with decades of Bronx experience.

Tsougranis said owning a home is nearly always a better financial move than renting, assuming the owners stay in the property for a long enough time.

“It’s the biggest hedge against inflation,” he told the Bronx Times.

For first-time buyers, Tsougranis’ biggest piece of advice is to “get yourself a broker who knows what they’re doing” to help navigate the complex real estate landscape, with its many different loan options and everchanging laws.

With today’s buyers spending more out of pocket than ever, a broker can help ensure the best deal, he said.

Many in New York City tend to assume that renting is easier and less expensive than buying. But with the right opportunity, owning can cost the same or less each month while building generational wealth, said Tsougranis.

This was the case for Singh, who said his monthly mortgage on the $550,000 purchase price is now about $2,200 — equal to about half the average Kingsbridge rent for three- and four-bedroom apartments, which runs from $3,795 to $4,600, according to the real estate website Zumper.

Although he had to make a “massive” downpayment to get the house he wanted quickly, his mortgage is now reasonable, within the standard guideline of spending no more than one-third of household income on rent or mortgage.

For about the same monthly cost, “We have a whole house, compared to like a two-bedroom [apartment],” Singh said.

More NYC residents should explore homebuying, and governments should prioritize programs that help owners, not just renters, Tsougranis said.

“I want to see homeownership in the Bronx and the city rise,” he said. “I want people to own something. I think that’s the American dream.”

Hot home prices

In certain pockets of the city, home prices are spiking like never before, presenting an opportunity for some to seize on their piece of the dream while values continue to appreciate.

Twenty-four NYC neighborhoods, including two in the Bronx, have seen prices rise more than 100% in the last 10 years (2014 to 2024), a June report by Property Shark showed.

Throughout the city, these massive spikes are happening in the Bronx neighborhoods of Parkchester and Calson Point, as well as Hollis and Long Island City in Queens, Red Hook and Prospect-Lefferts Gardens in Brooklyn, among others.

With Metro-North connectivity planned for Parkchester, along with thousands of new residential units, the Property Shark report said the area is primed for “pre-gentrification” as it sees growing interest from corporate buyers.

In 2024, 72 Parkchester sales were registered to an LLC buyer, compared to only 19 in 2014, the report said.

Throughout the entire state, however, buying could become even more expensive in the next few years — and household incomes aren’t keeping pace.

A new report published by moving company HireAHelper shows that New York state has one of the country’s largest gaps between buyers’ incomes and median home prices.

Based on the standard guideline of spending no more than one-third of household income on rent or mortgage, a New York household would need to earn at least $179,704 to afford a home of median price, which is projected to reach $781,203 by 2030, according to the report.

The state’s current median household income of $75,000 would need to rise by 102.82% to meet that threshold, the study found. And it’s not just a New York problem. By 2030, income growth is expected to lag behind home prices in all 50 states.

‘Fell into my lap’

Regardless of one’s income, timing is everything when it comes to buying a home. Singh said he wasn’t necessarily looking to buy at that time but had to act quickly when the opportunity presented itself.

In 2020, his parents happened to chat with a neighbor who mentioned she planned to sell her house soon. Singh was immediately interested, even though he had a good rental situation living in his parents’ home.

He and his wife had stable jobs and wanted to expand their family, so they seized on the chance to buy the neighboring house before it hit the market. Even though they weren’t actively seeking to buy at the time, they believed it could work. Singh runs his family’s construction company and his wife is a teacher, so they had stable income and felt ready.

“This situation fell into my lap, so I just took advantage of it,” Singh said.

He believes he got a “pretty good deal” for the house, which sold for $550,000. While the median Kingsbridge home price is lower — about $310,000, according to the real estate website Zillow — Singh said other houses nearby have recently sold for close to $1 million.

The process wasn’t all smooth sailing, however. Singh said his initial realtor didn’t inform him and his wife early on that they were preapproved for a mortgage, so they believed their application was still pending, causing unnecessary stress and delays. Singh said he believes that the realtor stalled in order to “squeeze more money out of the situation,” so he began working with someone new.

He also had to make a “massive” downpayment and didn’t feel he was presented with many other options that might have reduced it.

Still, between snapping up the house before it hit the market to locking in pandemic-era low interest rates, “Everything worked out in our favor,” he said.

Help for first-timers

Although today’s interest rates are higher than when Singh purchased, several city, state and federal programs, as well as community nonprofits, aim to help first-time buyers break down some of the barriers to homeownership.

For one, the city’s HomeFirst down payment assistance program provides moderate-income first-time buyers with grants of up to $100,000 towards a down payment or closing costs.

Applicants must take homebuyer education courses and have household income of less than 120% AMI ($130,440 for a single person up to $246,000 for an eight-person family).

They must also remain living in the home for 10 or 15 years, depending on the loan type, and must contribute to the downpayment.

Although the program was abruptly paused in late 2023, leaving some prospective buyers in the lurch, it his since been fully restored and expanded this year, according to a spokesperson for the NYC Department of Housing Preservation and Development (HPD).

HomeFirst added $82 million in city funds over the next five years, in addition to existing federal funds, and has helped more than 1,100 New Yorkers buy their first home, Mayor Eric Adams announced in January.

The city is also working to incentivize homeownership from the development side.

Tsougaris, the Bronx realtor, is working with a newly-built co-op in the Soundview neighborhood that offers units exclusively for first-time buyers at 70% or 80% AMI. Twenty-three units are currently for sale.

The Soundview co-op was made possible by another city-funded program, Open Door, that incentivizes the creation of more affordable purchase units.

The program provides development subsidies that increase with deeper levels of affordability, and it provides funding long-term as units pass from one owner to the next.

Since 2017, the city has created more than 500 ownership units with Open Door, with more to come, according to HPD.

At the community level, several organizations, such as Bronx Neighborhood Housing Services, support wannabe homeowners as they navigate the buying process.

One BNHS client recently became a first-time owner in Pelham Parkway and now pays only $450 per month for his mortgage. The organization helped him secure the mortgage, plus a $40,000 grant, which he used for a downpayment and kitchen renovations.

Worth it

Singh in Kingsbridge said he was fortunate to have timing on his side, as well as guidance from his homeowner parents, as he started the process for the first time. More New Yorkers, especially those from diverse backgrounds, should have the opportunity to do what he did, he said.

Since moving into their house, Singh and his wife have had two more children, which he said may not have been possible if they had continued renting from his parents or elsewhere.

Even more to his advantage are his connections to the construction industry, which allow him to handle unexpected repairs at a good price. There have been some challenges, such as a clogged pipe that flooded the basement last year and having to buy a new water heater, but even those obstacles gave him a reassuring sense of responsibility, he said.

“I’m like, okay, this is my basement. I have to fix it up,” he said.

Five years later, Singh believes owning a home is well worth it. He even put his mark on the place, painting the garage doors with elaborate murals for his streetwear brand, Cash Cow NYC.

Singh said his friends are impressed that he could buy a house at a young age, and some seem inspired to follow in his footsteps.

“When they come over for a party or something, they’re like, ‘Oh, this is cool,’” he said.

Reach Emily Swanson at eswanson@schnepsmedia.com or (646) 717-0015. For more coverage, follow us on Twitter, Facebook and Instagram @bronxtimes