To the Editor,

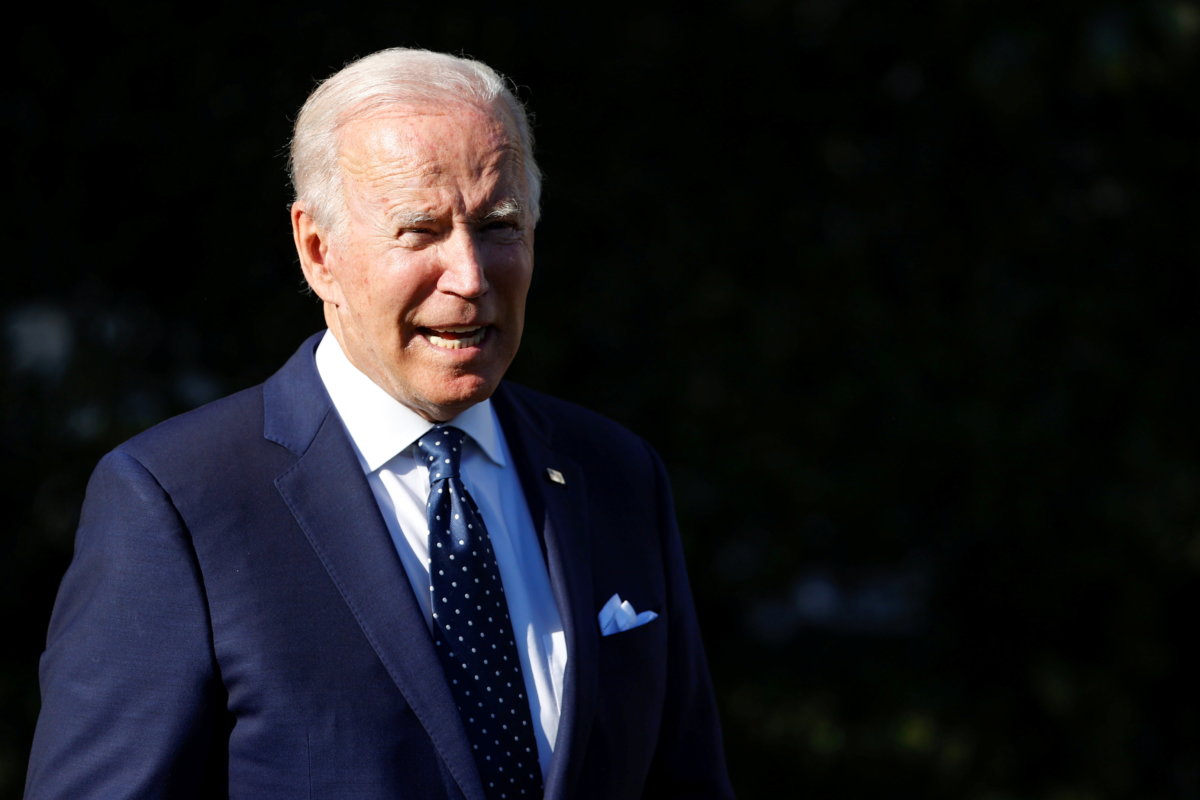

President Biden wanting Uncle Sam to forgive the first $10,000 in outstanding college loans sounds great. Senate Majority Leader Schumer wants to eventually raise it to $50,000. There ain’t no such thing as a free lunch or in this case a student loan. Too many elected officials promise “so called” free stuff from Washington. They believe that it will help grease the wheels of reelection. There are millions of American parents who saved and sacrificed to put their children through college. Many students worked at part-time jobs to attend college. Others worked full time during the day to afford attending undergraduate, graduate or law school classes at night. Some first attended less expensive community colleges and later transferred to four-year colleges.

Taxpayers are left with billions of dollars in uncollected debts. Biden wants Washington to just write off several hundred billion in outstanding student loan debt. Colleges and universities that are tax exempt have endowments worth more than $800 billion. Why don’t they contribute to reducing their own graduating students debt instead of taxpayers?

According to the Penn Wharton Budget Model, it is estimated that Biden’s forgiveness program will cost taxpayers $330 billion over the next 10 years. This does not include $270 billion more in Pell Grant forgiveness. There is also another $20 billion cost for a four-month moratorium on loan payments. This is on top of $115 billion incurred since the moratorium of loan repayments in response to COVID-19 was instituted. Uncle Sam faces $30.4 trillion in long-term debt.

Larry Penner